Charitable organisations were eager to see how the Budget would affect them. Here’s a summary of the key changes for the voluntary sector…

The Charity Governance Code has recently been revised and continues to be a helpful tool in assisting boards to pursue best practice.

Charities are subject to a range of regulatory and legal requirements designed to maintain public trust and confidence in the sector. Larger charities account

Without the hard work, dedication and commitment of trustees, there simply wouldn’t be a charity sector, Let’s celebrate that…

Are charities trusted? What are the current talking points affecting the sector? Have attitudes towards charitable organisations changed?

In this article, we’ve outlined some of the key aspects to be aware of and some of the most common situations where trustee payments crop-up.

Gift Aid is an effective way to maximise the value of donations, so the causes and purposes you serve benefit more. Read our helpful guide…

There’s a new survey asking trustees, who they are, how they feel about their role, and what skills they have/need to fulfil their role.

Receipts and payments accounts are simpler to prepare than accruals accounts, summarising the cash received and paid during a financial year.

Charities must be aware of the relevant legal and tax rules that apply to making payments overseas and supporting causes abroad.

A new resource has been published, designed to assist trustees and staff involved in governance decisions around charity investments.

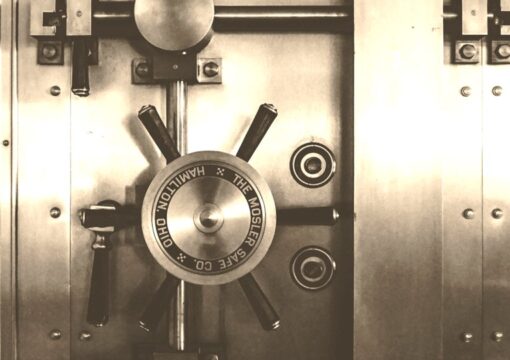

The Charity Commission has published guidance on cybercrime. Here are the risks, how to mitigate them, and what to do if an attack happens…

Working from a sound financial base means you can best assist your beneficiaries, but unforeseen difficulties can occur for a many reasons…

Charities did not feature significantly in the Autumn Budget 2024, but here’s a summary of some of the changes that will affect the sector…

Growing your charity might be a necessary process to keep up with demand for your services, but it carries its own risks…

The Charity Commission has published its research into ‘Charities and their relationship with the public,’ as conducted by BMG.

The Charity Commission has recently refreshed their guidance on online charity meetings to ensure specific procedures are followed.

The Gift Aid on Small Donations Scheme could deliver income of potentially £2,000 or more to fund your charitable work.

The Charity Governance Code is reviewed approximately every three years and the latest review is currently underway.

Read what’s practically involved in the audit process, how to prepare well and what to expect from us as auditor…

This article covers the important considerations in setting-up and running a trading subsidiary to raise money for your charitable work.

There’s a widespread misunderstanding of charity reserves and yet this is an area of vital importance to all charities. Are you up to speed?

In the current social, economic and political climate it’s more important than ever that charities act ethically.

With a rise in charity related fraud cases, organisations should be prepared for potential dangers and take steps to mitigate risks.