For most fully taxable businesses, VAT can be reclaimed on goods and services used in the business. This means that businesses must consider where

You may recall that a new Plastic Packaging Tax was announced in the 2020 Budget. The legislation is now before Parliament so we have

What is a multi-year contract? It’s simply a contract with your customer that lasts longer than one year and gives you both some financial

The success and long-term value of any business depend heavily on the relationships it builds with its customers. Therefore, your company’s most valuable asset

The Employment Allowance enables eligible employers to reduce their National Insurance liability. The maximum allowance for the 2021-22 tax year is £4,000, or your total

The trivial benefits in kind (BiK) exemption applies to small non-cash benefits like a bottle of wine or a bouquet of flowers given occasionally

As part of its “Plan for Jobs”, the government has now announced that, from 1 June 2021, employers of all sizes in England can

6th April marks the start of the new tax year for us in the UK. But have you ever wondered why we picked such

You can now find the key tax rates and allowances which will be affect our business and personal lives in 2021/22 – just click

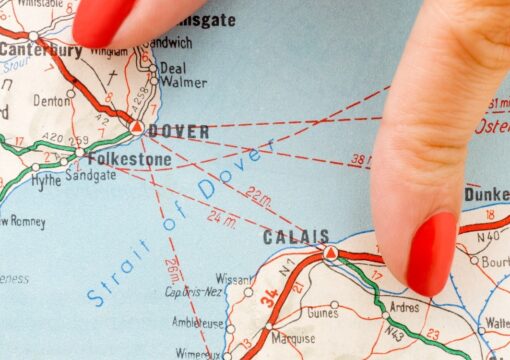

It is well over a month since the implementation of a full border between the UK and the EU. Because of the pandemic, trade

INTRODUCTION New VAT rules are due to come into effect from March 2021 which will impact on accounting for VAT for transactions in the

Managing your accounts, tax returns and VAT can be difficult. Our services aim to keep things simple, so you can focus on what you’re best at.

Literally, the word depreciation means a reduction in the value of an asset over time. It recognises the fact that if you buy assets for your business – cars, plant, computers etc – as time marches on the value of those assets will

1 July 2020 – Due date for Corporation Tax due for the year ended 30 September 2019.

6 July 2020 – Complete and submit forms P11D return of benefits and expenses and P11D(b) return of Class 1A NICs.

19 July 2020 – Pay Class 1A NICs (by the 22 July

A voluntary VAT deregistration can be made if you do not expect your taxable turnover to exceed the VAT deregistration limit. The current deregistration limit is £83,000.

If you are running a small business that has been adversely affected by