The success and long-term value of any business depend heavily on the relationships it builds with its customers. Therefore, your company’s most valuable asset

What is cross-selling One of the easiest and best ways to increase your business’s revenue and profitability is by cross-selling more services to your

The Employment Allowance enables eligible employers to reduce their National Insurance liability. The maximum allowance for the 2021-22 tax year is £4,000, or your total

The trivial benefits in kind (BiK) exemption applies to small non-cash benefits like a bottle of wine or a bouquet of flowers given occasionally

As part of its “Plan for Jobs”, the government has now announced that, from 1 June 2021, employers of all sizes in England can

If your business goes through a tough period, it may be time to pivot your strategy. Necessity is the mother of all invention. Many

You can now find the key tax rates and allowances which will be affect our business and personal lives in 2021/22 – just click

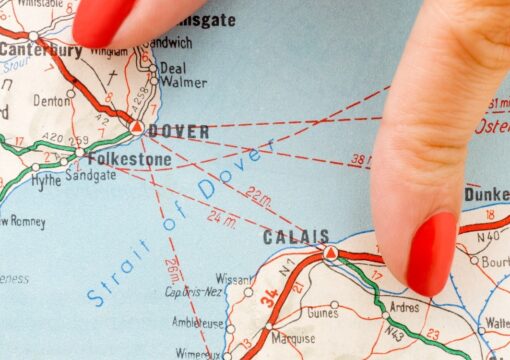

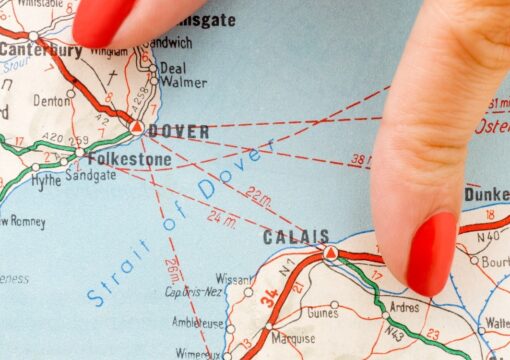

It is well over a month since the implementation of a full border between the UK and the EU. Because of the pandemic, trade

INTRODUCTION New VAT rules are due to come into effect from March 2021 which will impact on accounting for VAT for transactions in the

‘For me, the best things about working with Burton Sweet, are the peace of mind and good regular communication they provide. I am always advised in advance of any action required. The time and guidance they gave when I started out was, and still is, priceless to me.’

We support limited companies from a range of sizes, sectors and situations, so they can make the correct decisions, as supported by the data.

Acas has published a process map for employers who are having to consider making redundancies due to coronavirus. The interactive tool has been designed to help employers better understand redundancy processes, required steps and good practice when