Whilst marriages and civil partnerships are about love and finding your life partner, it’s worth being aware of the tax implications involved. It’s not all roses. This article specifically outlines some of the affects on Inheritance Tax that are associated with these legal partnerships.

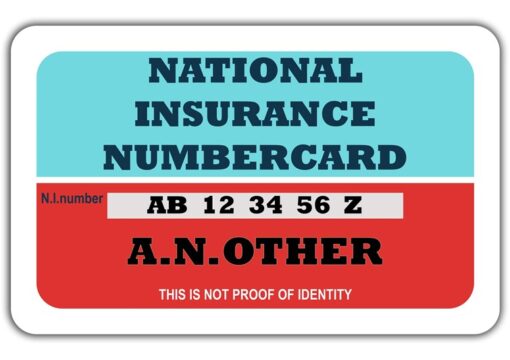

As a result of ‘administrative discrepancies’ by the Department of Work and Pensions (DWP), mothers may have been underpaid around £1bn in state pension. This has occurred due to information missing from the national insurance (NI) records.

In an attempt to slow price rises, the Bank of England has increased interest rates for the thirteenth consecutive time to 5%, the highest in almost 15 years.

The new tax year has begun; this means we can now submit your tax return for the year ending 5 April 2023. The final deadline may seem a way off, but submitting as early as possible is always preferable, so you are aware of any tax liabilities in good time. Here’s a checklist of things you may wish to consider.

After April 5 2025, you’ll only be able to fill National Insurance gaps going back 6 tax years, so if you have many years missing on your record, you should start considering what you can do about this.

For a round-up of what the Spring Budget contained and how this might affect you, please read our summary of some of the major changes.

What’s in it and how might it affect you? On the 17th of November 2022, Jeremy Hunt revealed the details of his Autumn Statement.

Young persons who turned 18 on or after 1 September 2020 may have cash waiting in a dormant Child Trust Fund (CTF) account. This

Your tax code is used by your employer or pension provider to work out how much Income Tax to take from your pay or pension.

Employers use an employee’s National Insurance category letter when they run payroll to work out how much they both need to contribute. Most employees

Have you ever been pushed into buying something that you really didn’t want? Most of us have. Maybe it was a salesperson over the

New health and social care Levy to be introduced across the UK to provide extra cash to reform the Health and Social care systems