At some point in the running of your business you will need to thoroughly understand profit and loss (P&L).

Your profit and loss statement (also known as an income statement) shows your revenue and expenditure, leaving you with the resultant profit or loss for the period. This can be represent an indicator for your long-term success. A dip in profitability or a ‘boom’ year does not immediately result in disaster or victory, but a trend of steady profits will allow your business to grow, whilst allowing you to withdraw some profit over time.

All limited companies must produce a P&L account (and a balance sheet) as part of their annual financial statements. The P&L is not always publicly available as you can currently ‘fillet’ them in smaller companies when you submit them to Companies House. In October 2023, the Economic Crime and Corporate Transparency Act legislated that small businesses and micro-entities will also need to file a P&L account with Companies House in the future. The date for when this commences has not yet been determined.

This article will cover some P&L statement basics, as well as exploring what this information can tell you…

1. Turnover

Turnover always bear the risk of being considered the most important number in the accounts; the thought being that if your sales are high, your profits will follow. However, this is often known as the ‘vanity’ number of P&L.

Growth in sales is desirable, but you need to be careful at what cost this comes. A sales manager under-selling the business may raise the top line (revenue), whilst reducing the bottom line (profit).

2. Gross profit

Cost of sales are the direct costs incurred by your business to generate sales. In a product manufacture and sales company, it is the cost of making the product. This could include raw material costs, direct salaries, or the running costs of machines.

For a service-based company, this will be the costs of employing the direct staff serving your customers.

Regularly monitor your P&L. Operating costs (see below), may not fluctuate with a growth in sales and gross profit. So, managing your way to an increase in gross profit can really affect the success of the business.

For owner-managed businesses, where you generate much of the income yourself, you may wish to consider (as a thought exercise) what your market rate cost of sales would be. The more gross profit generated by the company with a market rate person in the role, the more valuable the business is as an asset.

3. Operating profit to profit for the year

Administrative expenses are the costs of running a business day-to-day, indirect to creating the product/service, such as rent, utilities, and administration costs. Salaries for administrative staff, not directly involved with delivering the product/service would be included.

Operating profit shows what the business has generated as a core before peripheral items such as ‘other income’ or ‘interest payable.’ This is the profit generated outside of the asset or debt structure the business resides in.

If the business is highly geared (a large proportion of debt to the activities of the business), then the operating profit will need to be sufficient to cover the costs of having this debt. Significantly, healthy operating profits translate to a healthy profit before tax and ultimately the profit for the year.

Profit for the year adds to the distributable reserves of the business (profits for shareholders that can be taken out as dividends). For a partnership or sole trader, the profit before tax is split between partners and taxed as income on their personal returns.

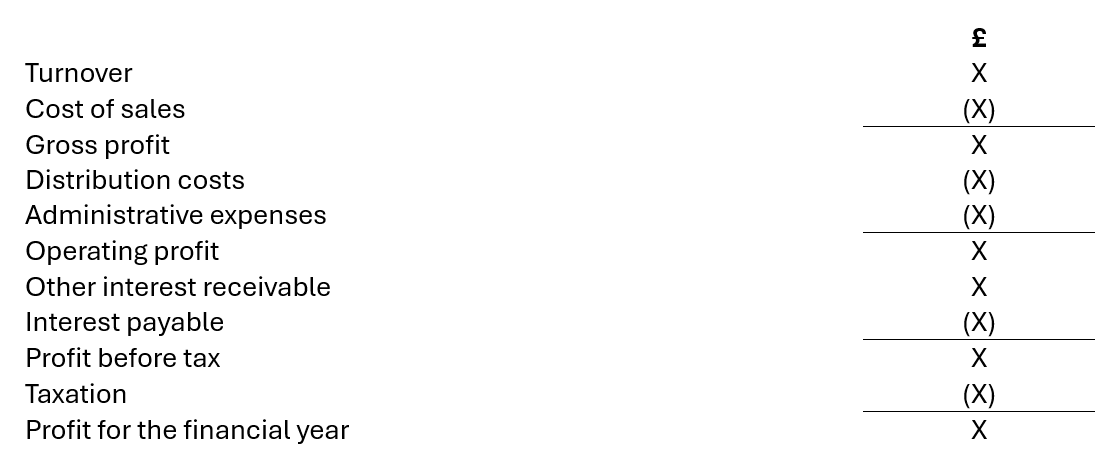

Your P&L statement might be set out like this…

Uses for your P&L statement

A detailed P&L gives you more information on what contributes to the sales and expenses of the business. Take a moment to review this as the year progresses, so you can review and familiarise yourself with trends.

If you take your P&L and adapt it, you can gain valuable management information, such as:

- Observe activities and profit centres that are generating gross profits, or causing problems with low gross profits.

- Assess your current P&L statement with previous periods, to identify performance trends.

- Compare your P&L to your budget to see if you are meeting, surpassing, or falling short of expectations.

- Set forecasts or future targets from the current performance of your P&L statement.

- Alongside your balance sheet, calculate rates and ratios for a more insightful perspective on your finances.

How does the balance sheet fit in?

A balance sheet is a snapshot in time of the assets and liabilities (and reserves) that a business has. Where the balance sheet shows the position, the P&L shows the performance of the business. When combined, the balance sheet will show you where the business has ended up and the P&L will show you how you go there.

Get some insight…

The more often you are considering your business’s P&L the better. It will assist you in making key decisions, understand where you are performing well and where to direct your attention.

If you require assistance with producing, interpreting and taking action from your business’s P&L statements, please contact us and member of our team will be happy to assist you.