Minimum wage is the lowest legal hourly rate that an employer can pay a worker.

‘Workers’ might include people who are employed part-time, via an agency, or casually (such as someone hired for a single day). Self-employed individuals and volunteers are not entitled to the minimum wage.

Pay rates are set by the government every year, with advice from the Low Pay Commission, an external, independent group.

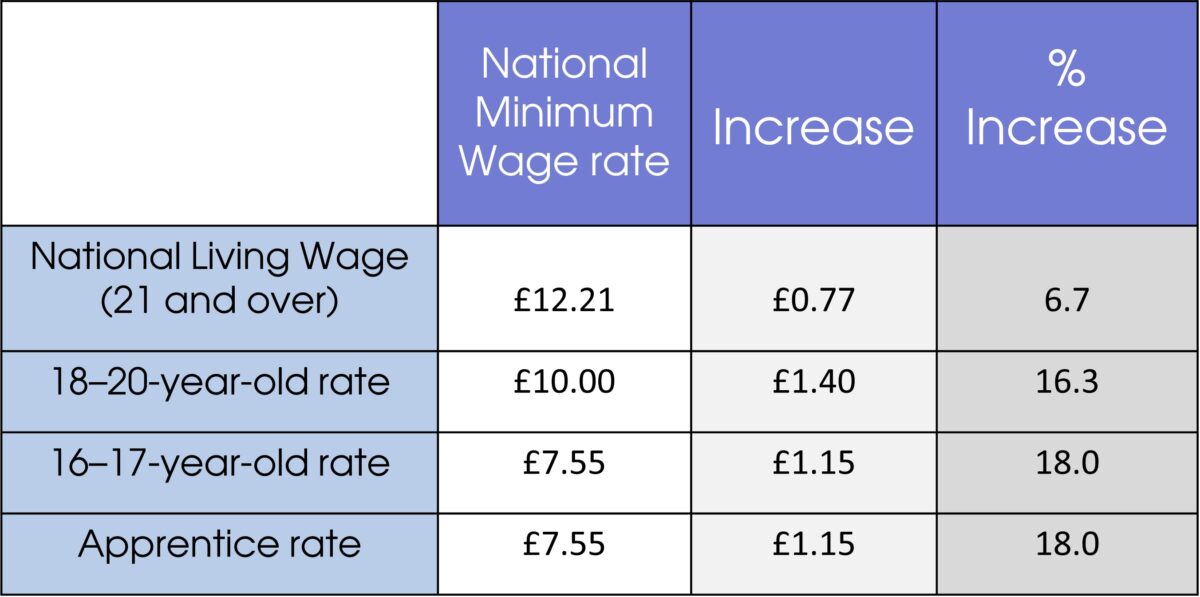

In the Autumn Budget 2024, the Chancellor announced that minimum wage rates would be increasing on 1 April 2025:

It is estimated that this raise to the National Living Wage will be worth £1,400 a year for an eligible full-time worker.

The government has also lifted the minimum wage rates for people aged 20 and below, many of whom will work part-time. This represents the largest rise on record, as this government aims to establish a single adult rate in due course.

What should businesses do?

It’s a criminal offence when an employer does not pay the correct minimum wage to their workers, even if staff are not paid by the hour. They risk being fined by HMRC.

Payroll systems need to be updated to match the new rates, considering how this might impact on other wage related factors, such as overtime and bonuses. You may wish to review how your employment contracts are structured to best manage your business’s cash.

It’s vital that you can pay your workers this new minimum wage, without disrupting other aspects of your business. Talking to a professional outside your organisation could assist you in making the most productive adjustments.

Potential pros

From a broader perspective, raising minimum wage should work towards improving the overall standard of living for low paid workers, by keeping pace with inflation and the cost-of-living.

Another positive outcome might be reducing the need, and consequently the government spend on social support, as poverty is less prevalent. Some argue that giving employees more money will increase spending, benefiting other businesses and fuelling the economy.

For businesses, offering a desirable wage will not only enhance your reputation, but make recruiting and retaining staff easier, with less need for marketing spend. Existing employees are more likely to be engaged by their work, with good will towards their employers if they are paid fairly. This should ultimately lead to greater productivity.

Potential cons

Amongst the budget’s most divisive measures was that from April 2025, businesses will have to pay NI on workers’ earnings above £5,000 (currently £9,100), with the rate increasing from 13.8% to 15%. This is relevant because lowering this threshold, alongside raising minimum wage and ever-increasing utility bills, may cumulatively put strain on businesses.

With more labour costs, organisations might opt to raise the prices of their products and services. In this scenario this would then increase the general cost-of-living and inflation, negating any effect that a higher minimum wage might have.

Concerned business owners have argued that they may have to cut back on hiring as a result, reduce workers’ hours, and even consider layoffs. This may lead to a focus on boosting productivity, rather than headcount.

Another potential problem is wage compression, where the lowest paid workers close the pay gap on their more senior colleagues. This could result in an unwillingness from employees to accept promotions, with more responsibilities but (in their mind) insufficient reward. Pay rises might also be limited.

Note: These potential pros and cons are for the moment only projections. The effects of this change will have to be assessed in action after April 2025. It’s also worth remembering that the minimum wage is raised regularly, year-on-year.

Need some guidance?

If you are concerned about how the increase to minimum wage, amongst other increasing costs might affect your organisation, then please contact us. A member of our team will be happy to discuss this with you and consider potential actions you can take.