As a charity, keeping good accounting records should be a top priority. It’s at the heart of both excellence in public accountability and effective decision making.

Section 130 of the Charities Act 2011 requires trustees to ensure that accounting records are kept which are ‘sufficient to show and explain all the charity’s transactions.’ These accounting records must also be capable of disclosing ‘at any time, with reasonable accuracy, the financial position of the charity at that time…’

However, good records also help trustees to discharge their core duties, by facilitating good decision making and planning (usually through the regular preparation and use of management accounts), as well as enabling the preparation of year-end accounts and reports for public filing.

What are accounting records?

Charity Commission guidance defines accounting records as ‘the trustees’ records of the financial transactions undertaken by the charity and includes any books (including computer records) in which transactions and events from day-to-day are entered, together with all the relevant invoices, receipts, vouchers and other associated documentation.’

In practice, you need to ensure you record the following for each financial transaction:

- Date of the transaction

- Name of the payee or donor/customer

- Amount

- Income/expenditure or asset/liability heading

- A narrative description, or explanation to ensure the nature and purpose of the transaction is understood

- The fund to which the transaction relates (this is important to satisfy trust law)

- Transaction method (e.g. cash, bank transfer, PayPal etc.)

- VAT treatment (if the charity is VAT registered or soon will be)

- Reference/link to/attached supporting documents

It’s important to recognise that accounting records include the associated documentation that accompanies a financial transaction. These documents need to be kept in a clearly referenced and accessible way, either in paper form or in a scanned electronic format.

Such documentation includes the following:

- Receipts

- Grants (letters, conditions, remittance)

- Room hire/lettings (invoice, evidence of receipt)

- Donations (correspondence, Gift Aid claims and declarations)

- Cash from events (count sheets)

- Payments

- Purchases (authorised invoices, receipts for small items)

- Volunteer expenses (claim forms, receipts)

- Travel expenses (receipts, details of mileage with purpose of journey)

- Bank statements and reconciliations

- Investment statements and correspondence with advisors

- Trustee meeting minutes – (evidence of decision/authorisation)

What are your bookkeeping options?

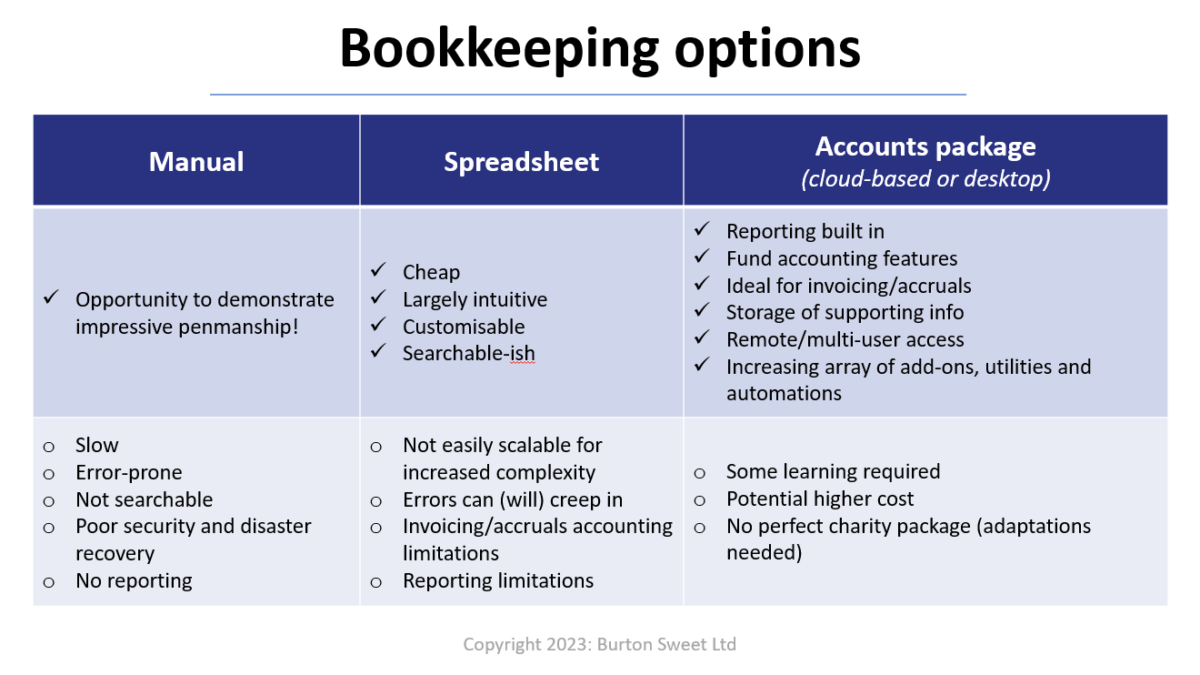

Manual or paper-based ledgers and cashbooks are justifiably becoming extinct given their limitations and the options available. We would never recommend this choice to a charity of any size, given the drawbacks of poor security, lack of validation features and their reporting limitations.

It’s valid for small, simple cash-based charities to use spreadsheets to record financial transactions, but charities often outgrow these quickly.

In our experience, every charity can benefit from the features of modern cloud-based accounting systems, which include ease of reporting, good security, remote access, the ability to automate and streamline daily processes, alongside efficient handling of accruals adjustments.

Check out our at-a-glance comparison of pros and cons of each type of system below and for further considerations, please read our recent article on this subject.

Top tips for success

Think ahead!

Implementing any new system requires clear planning. Think ahead and plan for your chart of accounts (headings) well before you start entering transactions. What information will users of the accounting information the system generates need to know? What format of management accounts needs to be produced from this system? Talk to the trustees and understand their needs. A great question to ask them is: ‘Will this information help you to make decisions?’

Be organised and systematic

At Burton Sweet, our experience is that the best bookkeepers are not necessarily qualified accountants, but are instead good administrators, who take an organised and systematic approach to their work. Make sure that every transaction is posted at initiation and that all supporting documentation is promptly filed and either referenced well, or attached as an electronic copy to the transaction within your accounting system.

Get a grip on accuracy v timeliness

If you are producing regular management accounts, it can be tempting to spend lots of time making sure every transaction has been perfectly classified, every accrual captured, or prepayment identified. The time this takes can sometimes lead to a delay between the period end and the management accounts being available to the trustees/staff of the charity. This diminishes the usefulness of this information when it comes to decision making. There is a trade-off between accuracy and timeliness, so put your focus on the key areas that matter most.

Consider continuity and segregation of duties

Try not to be the only person in your charity who knows how to use or obtain information from your system. Spreading the knowledge will help your charity to both continue operating in the face of disaster or illness and act as a helpful mitigation against the risks of error or fraud.

Need some support?

Burton Sweet has a longstanding commitment to charities and civil society organisations, offering practical, professional and passionate support. We want to assist you, so you can deliver effectively for the communities you serve and show the good you do.

Our team can work with you to assess your bookkeeping needs, provide you with a cloud-based accounts package subscription and support you with initial implementation as well as ongoing and training and help. We also offer a bookkeeping and financial outsourcing service, which can include the preparation of management accounts.

If you would like some guidance on this or any aspect of running your charity, please get in touch with our Head of Charity Development, Ed Marsh…