There is a new scam letter targeting businesses, requesting taxpayers ‘verify’ their financial information via email.

Scammers often pretend to be the tax office in calls, texts, emails and (less often) letters to obtain money or personal information. If successful, this scam could be used to commit identity theft, so the perpetrators could take out loans and finances in a company’s name and money from a director’s bank account.

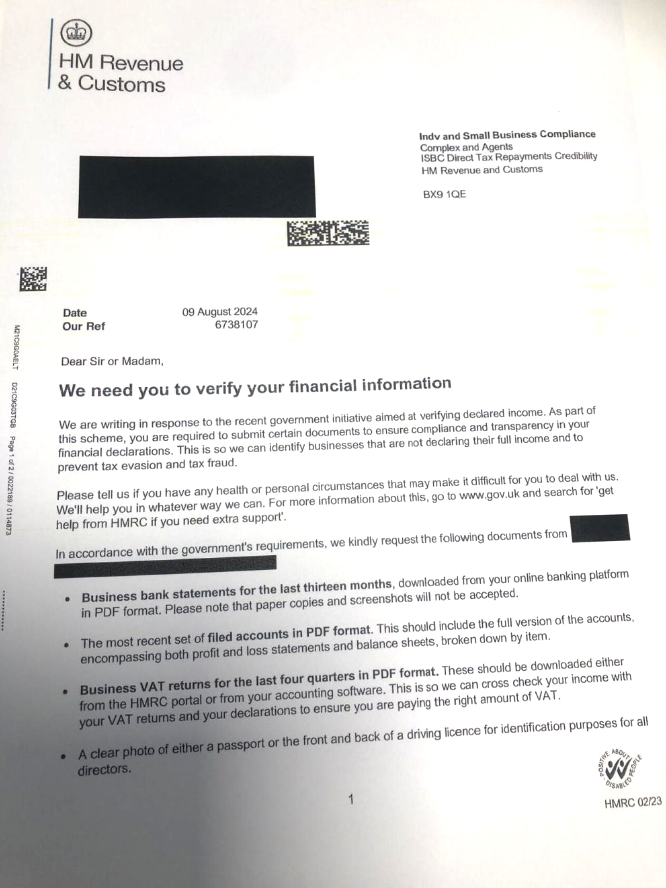

The letter looks very similar in format and font to letters you may have received from HMRC, even containing a link to the official government website. Unlike other scam letters, it does not contain spelling errors or layout irregularities that might alert your attention.

The letter

Features of the letter include:

- The BX9 1QE postcode at the top of the letter, which corresponds to an HMRC sorting office.

- Claims to be from HMRC’s Individuals and Small Business Compliance Team, writing to taxpayers in response to ‘the recent government initiative aimed at verifying declared income.’

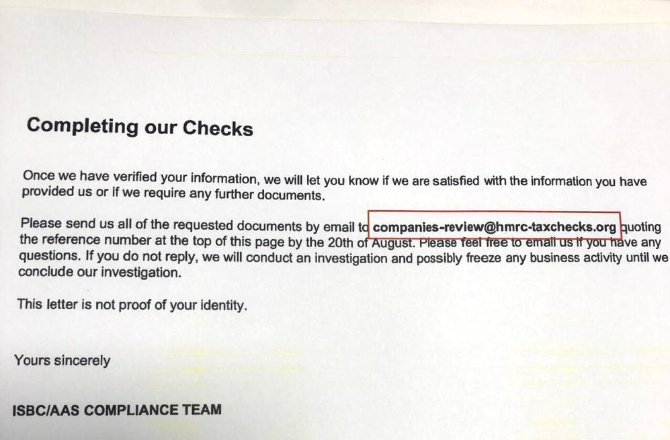

- An appeal to recipients to send requested documents in PDF format (bank statements for the past 13 months downloaded from their online banking; the most recent set of filed accounts, including both profit and loss statements and balance sheets broken down by item; business VAT returns for the past four quarters) to hmrc-taxchecks.org for review and quote the reference number at the top of the letter.

- A request for recipients to email a copy of their passport photo or driving license for ‘identification purposes’ for all directors.

- ‘Once we have verified your information, we will let you know if we are satisfied with the information you have provided us or if we require any further documents.’

- A threat that: ‘If you do not reply, we will conduct an investigation and possibly freeze any business activity until we conclude our investigation.’

The primary indication that this letter is not legitimate are the false email (companies-review@hmrc-taxchecks.org) at the bottom of the letter and an incorrect tax reference.

Here’s what the letter looks like…

(Images from Azets)

A HMRC spokesperson said:

‘Tax scams come in many forms. Some offer a rebate, others tell you that your tax details are out of date, or threaten immediate arrest for tax evasion. Never let yourself be rushed. If someone contacts you saying they’re HMRC, wanting you to urgently transfer money or give personal information, be on your guard. We will also never ring up threatening arrest. Only criminals do that. Unexpected contacts like these should set alarm bells ringing, so take your time and check HMRC scams advice on gov.uk.’

What can you do?

With potential scam communications:

- Look at the government website to see if the information matches what they’re currently sending out, or what scams have been recently reported

- Never click any links

- Google the postal address, phone number, or email address

- Check if the logos (images) are correctly formatted or distorted

You can report scam letters (that claim to be from HMRC) by contacting the relevant HMRC team, the tax compliance team in relation to this particular scam.

For other fraudulent mail, you can send this to Freepost Royal Mail Customer Services. You can also complete a form to report scam letters.

Additionally, you may choose to report the scam to Action Fraud.

If you’ve lost money to a scam, contact your bank immediately using the number on the back of your card.