In June, as part of our new Business Improvement Support Packages, we ran a 4-week masterclass delivering financial and business improvement education to business owners ranging from small to large enterprises.

Your annual accounts are necessary for Companies House and HMRC, but they tell you what happened last year – they don’t help you run your business in future.

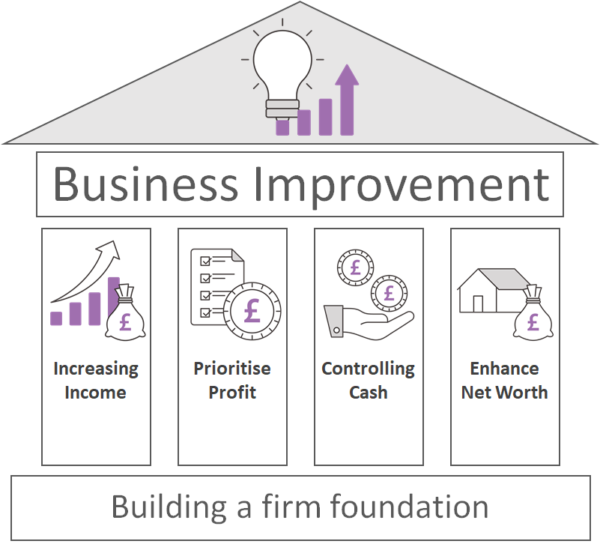

About Business Improvement Masterclass

Further Masterclasses will be available to clients who subscribe to one of our Business Improvement Support Packages.

These 45-minute classes each week in June explained the four pillars of a successful business and how you can apply them yourself.

The aim was to educate clients on practical ways to improve their business. The strategies discussed in these classes ranged from mapping out goals and objectives for quick wins, to advancing yearly progressive plans to refine your business goals to build long term value and reduce the stress of financial uncertainty.

As accountants, we are here to advise you on how to improve the performance and value of your business; that’s our promise to all clients.

Class Agenda

Prioritising Profit | June 2nd

– Turnover for vanity, profit for sanity

Too many businesses become obsessed with increasing turnover and don’t focus enough time and thought on how they could improve their margins to generate more profit without needing to increase their turnover.

What attendees learnt:

- The magic of compounding –

- Demonstrating how making multiple minor incremental improvements could make BIG changes to your gross profit.

- Why you need a creative pricing strategy –

- Explaining the beneficial difference between “Standard Pricing Strategies” to “Dynamic Pricing Strategies”,

- How to measure your profit margins accurately –

- Identifying which overheads are a cost and which should be an investment to focus on increasing your return on investment.

Enhancing existing customer spend | June 9th

– Why farming is more important than hunting

Becoming too focused on generating new customers often means we miss out on opportunities and additional income that can be more comfortably generated from our existing customers by applying a few well-proven strategies.

What attendees learnt:

- How to ask for and generate more referrals from existing customers –

- Identifying your happy clients and why you should prioritise them in your refferral efforts

- How to upsell and cross-sell effectively

- Explaining why one of the easiest and best ways to increase your business’s revenue and profitability is to sell more to your existing clients.

- Why you should be focused on the customer lifetime value

- Knowing the future value of your clients and aim to build long lasting relationships with them.

Controlling cash | June 16th

– Understanding the lifeblood of your business

We miss it when we don’t have it, and a lack of it causes us sleepless nights, but far too few businesses have strategies and systems to ensure that they actively control and maximise the amount of cash they have in their business.

What attendees learnt:

- Why you need a cash collection process

- Understanding why stadardising an automated procress improves efficiency, predictability and reduces reliance on individials.

- How to ensure your business model is a cash positive one

- The importance of understanding current cash flow, invoicing policies and how why you should renegotiate with suppliers for potential discount deals.

- Why your liquidity ratio is arguably your most important metric

- Knowing your balance sheet metrics, reviewing debt structure and exploring the the causes of liquidity issues.

Optimising Net Worth | June 23rd

– Building long term value

At the end of the day, your business should serve you and not the other way around.

For this to occur, you need to focus on a few key areas to enhance both the value of the business and the amount you can take from your business.

What attendees learnt:

- Why your business should prioritise recurring incomes streams.

- Focus on relationships not transactions, think about contracts, commitment and loyalty.

- Why you should create ideal client personas and focus on them.

- Increasing your value propersision to increase retention and loyalty.

- How to create an autonomous business that operates without you

- Pass on responsability and keep leaders accountable.

- Introduce dashboards and scorecards to measure performance.

- Coach and teach. Lead more than manage.

- How to structure your business to maximise the dividends you can draw

- Minise liabilities and tax: Negotiate interest rates/ terms.

- Project tax commitments in advance

- Maximise asset value: Only purchase assets that increase in value, create a remarkable brand.

- Reduce fixed overheads: Flexible employment contracts, performance related pay and minimal premise costs.

Recording and Slides.

Each Masterclass was recorded. Please email armando.barron@burton-sweet.co.uk if you would like access to the recordings and a copy of the presentation slides.