The new tax year has begun; this means we can now submit your tax return for the year ending 5 April 2023. The final deadline may seem a way off, but submitting as early as possible is always preferable, so you are aware of any tax liabilities in good time. Here’s a checklist of things you may wish to consider.

Accurately completing the Charity Commission Annual Return should be a top priority for all charity boards. The data declared on it is used by the Commission to regulate the sector and is often the first information a member of the public will see about your charity, when searching on the charity register.

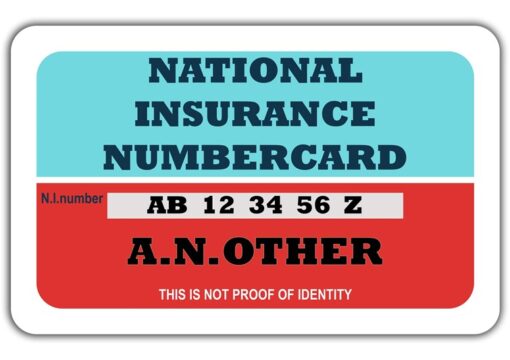

After April 5 2025, you’ll only be able to fill National Insurance gaps going back 6 tax years, so if you have many years missing on your record, you should start considering what you can do about this.

There are always competing factors to consider when thinking about your March year-end as a company. How prepared do you feel?

For a round-up of what the Spring Budget contained and how this might affect you, please read our summary of some of the major changes.

In an attempt to boost the post-pandemic economy, the super deduction tax rate and special rate allowance were introduced to encourage businesses to invest and boost productivity. However, these reliefs are coming to an end…

In March 2021, when Rishi Sunak was Chancellor, the Corporation Tax rise was first announced. After some confusion that arose from the mini-budget, Jeremy Hunt has since confirmed that this rise will still take place in April 2023.

What’s in it and how might it affect you? On the 17th of November 2022, Jeremy Hunt revealed the details of his Autumn Statement.

Employers use an employee’s National Insurance category letter when they run payroll to work out how much they both need to contribute. Most employees

Having listened to stakeholder feedback from businesses and the accounting profession, the government have announced that they will introduce Making Tax Digital (MTD) for

Would you like someone to take care of your company’s day-to-day financial challenges? Running a business can be complex enough without the additional concern

Have you ever been pushed into buying something that you really didn’t want? Most of us have. Maybe it was a salesperson over the

New health and social care Levy to be introduced across the UK to provide extra cash to reform the Health and Social care systems

As business advisors, we often ask prospects and clients who their target market is. One answer that comes up from time to time up

There is a well-known saying that’s proven to be true time and time again: “You need to spend money to make money.” But it