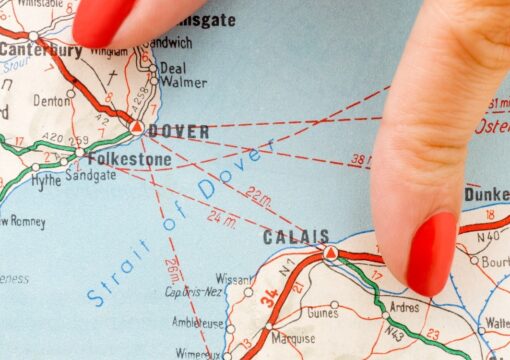

It is well over a month since the implementation of a full border between the UK and the EU. Because of the pandemic, trade

INTRODUCTION New VAT rules are due to come into effect from March 2021 which will impact on accounting for VAT for transactions in the

HMRC’s guidance lists the following useful examples about a change of accounting date:

If your accounting date in 2016 to 2017 is more than 12 months after the end of the basis period for 2015 to 2016, your basis period is the period between

The assessment of self-employed or partnerships profits is usually relatively straight-forward if the accounting date, to which accounts are prepared annually, falls between 31 March and 5 April. However, overlap profits can arise where a business

[et_pb_section bb_built=”1″][et_pb_row][et_pb_column type=”4_4″][et_pb_text admin_label=”Fortnight” _builder_version=”3.0.106″ background_layout=”light”] Burton Sweet are running a fortnight of Exit Planning and Business Valuation advice from Monday 21st May –