April 7th 2017. We are pleased to announce that Baldwins Chartered Accountants have agreed to purchase part of our business operating from the Dursley

The Burton Sweet Charity Team have a busy few months coming up, here are the latest key dates for your diaries: Quartet Community Foundation.

When: Tuesday 8 November 2016, 6.15pm – 7.30pm At: The Chapter House, Bristol Cathedral (entrance via Anchor Road/College Square, Bristol BS1 5TS) Guest speaker:

In association with Brewin Dolphin, Burton Sweet are holding a training event for trustees and senior managers of charities hosted by Bristol Music Trust

Last night saw the great and good of the region’s business leaders attend the Business Leader Awards in Bristol, for which Burton Sweet’s Managing

We are delighted to announce that Burton Sweet now have a presence in Frome. Tim Hirst, of T D Hirst & Co, has invited

NOTE: THIS EVENT HAS REGRETTABLY BEEN CANCELLED PLEASE CALL EMMA ON 01934 620011 TO OBTAIN YOUR COPIES OF THE TAX & FINANCIAL STRATEGIES BROCHURES 2016/17

The result of the EU referendum was only announced on Friday 24 July, so the future for the UK outside the EU is by

As accountants we know that maintaining accurate accounts is imperative for our clients. But recently, we have been reminded of just how crucially important

We’ve moved We are delighted to announce that from Thursday 25th August, our Bristol office has a new address. We had been aware of ongoing parking

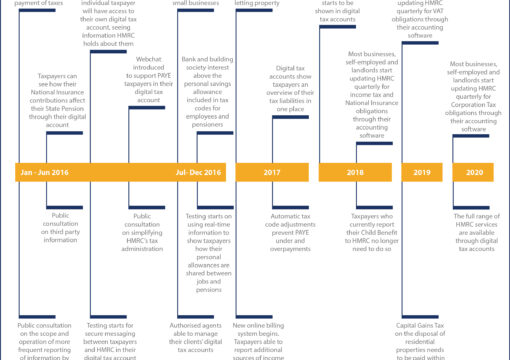

The biggest shake-up in self-assessment for years Back in his March 2015 budget, the Chancellor confirmed that self-assessment returns would soon be consigned to

This interesting article by Cecile Gillard, Legal Manager at Burton Sweet, gives you an overview update on the important company law and company regulatory

Individuals that own and let property are facing a number of changes to the way in which their rental income, and more importantly, the

Cruising or all at sea? Burton Sweet Autumn Charity Seminar 30 September 2015 9am – 2pm at M Shed events suite, BS1 4RN A morning

The ICSA Level 4 Certificate in Charity Law and Governance qualification is a brand new qualification that will be offered by ICSA from January