What is cross-selling One of the easiest and best ways to increase your business’s revenue and profitability is by cross-selling more services to your

The Employment Allowance enables eligible employers to reduce their National Insurance liability. The maximum allowance for the 2021-22 tax year is £4,000, or your total

The trivial benefits in kind (BiK) exemption applies to small non-cash benefits like a bottle of wine or a bouquet of flowers given occasionally

Most gifts made during a person’s lifetime are not subject to Inheritance Tax at the time of the gift. There’s usually no Inheritance Tax

There is usually no Capital Gains Tax (CGT) to be paid when you sell your main family residence (referred to by HMRC as private

As part of its “Plan for Jobs”, the government has now announced that, from 1 June 2021, employers of all sizes in England can

If your business goes through a tough period, it may be time to pivot your strategy. Necessity is the mother of all invention. Many

A thought-provoking question that has been asked by one of our readers is whether professional gambling is a trade or not. The answer to this question might surprise you. According to HMRC and reinforced by a number of court cases is the answer that

6th April marks the start of the new tax year for us in the UK. But have you ever wondered why we picked such

You can now find the key tax rates and allowances which will be affect our business and personal lives in 2021/22 – just click

Event Summary At our well-attended online catch-up on 28/01/2021 the Burton Sweet Charities and Civil Society Team shared some key considerations for charities in

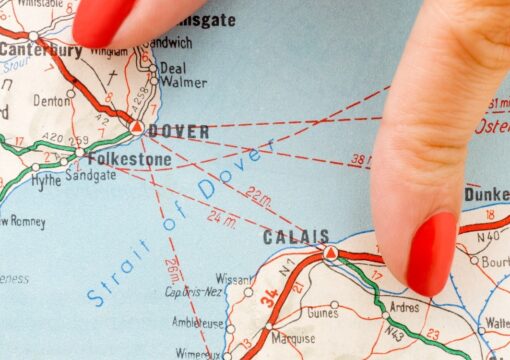

It is well over a month since the implementation of a full border between the UK and the EU. Because of the pandemic, trade