In a fit of creativity, I asked an AI engine to write a short introduction to this article on charity funds in the style of Sherlock Holmes…

In the realm of charitable endeavours, where benevolence intertwines with intrigue, one finds a curious enigma that lies at the heart of countless philanthropic endeavours. It is a conundrum shrouded in secrecy, an intricate web of restricted and unrestricted funds. Like a cryptic puzzle waiting to be solved, this peculiar duality challenges the discerning mind.

Exciting…and probably superfluous! However, there is an element of detective work needed when considering questions around charitable funds.

Background to charity funds

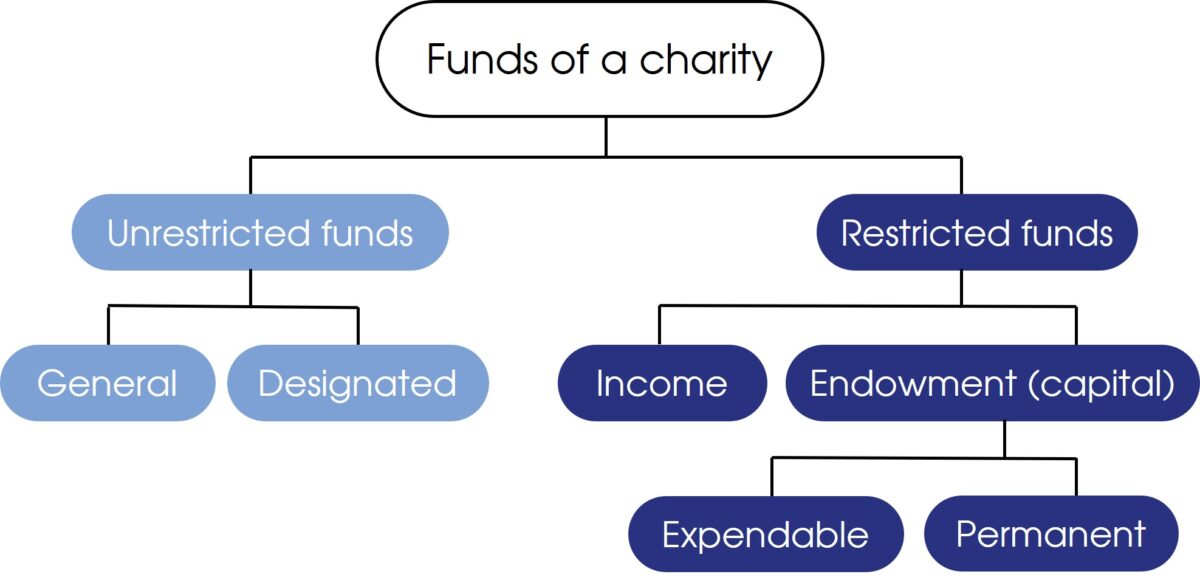

Under charity law and as detailed in Module 2 of the Charities SORP, a charity’s funds are either income funds or capital funds, and are either restricted or unrestricted.

Unrestricted funds are free to use for any activity within the charity’s purposes.

Designated funds are a part of unrestricted funds that a charity’s trustees can choose to set aside for particular specific purposes. Designated funds remain unrestricted and trustees can undesignate or redesignate these at any time. This can happen as long as the purpose of the designation is genuine and not simply for the purpose of ‘window-dressing’ the free reserves of the charity.

Restricted income funds, on the other hand, have legally restricted status and can only be spent by trustees on specific purposes; these criteria being narrower than the charity’s overall purposes. ‘Restricted funds’ is a legal concept and can only arise in the following circumstances:

1. When a donor specifies that their donation can only be spent on a particular purpose

2. When a charity launches a fundraising appeal for a particular purpose and invites donations towards that purpose

3. When the Charity Commission issues an order to a charity to establish a restricted fund and make contributions to it (it’s possible for charities to apply to the Commission for the power to create a restricted fund)

Endowment (capital) funds arise when a gift is given to be held by a charity as a capital asset, for use in its ongoing activities or to generate income for the charity.

- A permanent endowment has the nature of ‘restricted capital’ and must normally be held indefinitely. There is no power to convert it to income unless permission is sought from the donor or from the Charity Commission.

- An expendable endowment is a fund where the trustees have power to convert all or some of the capital fund into income, at its discretion. An expendable endowment normally arises where trustees recognise that the nature of the gift implies that the donor might have intended for it to be used for the long-term benefit of the charity, rather than spent immediately. In the absence of a specific, binding legal restriction to that effect, the capital funds are treated as expendable endowment.

Defining ‘free’ reserves

‘Free’ reserves are freely available to spend on any of the charity’s purposes. They have a narrower definition than total unrestricted funds, excluding any funds that are not readily available for spending. Drawing on these reserves may potentially negatively impact a charity’s ability to deliver its work. The Charity Commission guidance on Charity Reserves (CC19) says that a charity’s free reserves should exclude:

- Tangible fixed assets

- Programme-related investments

- Restricted funds

- Designated funds

- Endowment funds, both permanent or expendable

- Any commitments not provided for as a liability in the accounts

The exclusion of designated and expendable endowment funds from the definition of free reserves is often met with surprise by charity trustees, given their flexibility of use.

Fund queries

Applying the definitions above in practice can sometimes throw up some challenges. We come across all sorts of questions related to charitable funds in our day-to-day work and give situation specific guidance in each case.

Here are some questions you may have:

We’ve fundraised for a project and have excess funds, what do we do?

Can we use designated funds to provide investment income?

Can we simplify our funds disclosure?

What are the rules around endowment funds?

If you would like to clarify questions like those above, please do get in touch.

As Sherlock Holmes might say; our aim is to bring you closer to solving ‘the curious incident of the restricted funds in the charity’.

© Burton Sweet Ltd 2023