With the targets of reducing inflation, growing the economy and getting government debt falling, all whilst avoiding recession, Chancellor Jeremy Hunt presented his first Budget to Parliament on 15 March 2023.

For a concise summary of what the Spring Budget contained and how this might affect you, please check out some of the major changes below.

Energy

The Energy Price Guarantee: The EPG brings a typical household energy bill in Great Britain down to around £2,500 per year. It has now been announced that the £2,500 EPG will be extended by 3 months to 30th June 2023, before increasing to £3,000 until the end of the EPG period on 31 March 2024. This extra 3 months at £2,500 will be worth £160 for a typical household.

The Business Energy Bills Discount Scheme: A new scheme for businesses, charities and the public sector has been confirmed. This will run until 31 March 2024, giving non-domestic customers discounts on their gas and electricity bills.

Childcare

The ‘childcare revolution’: Additional support is being provided towards childcare costs; this includes 30 hours of free childcare for every child over the age of 9 months, with support being steadily introduced until every eligible working parent of a child under 5 receives this support by September 2025.

For Universal Credit claimants, the government will also pay childcare costs in advance rather than arrears, when parents move into work or increase their hours. The maximum they can claim will also be boosted to £951 for one child and £1,630 for two children, an increase of around 50%.

£600 “incentive payments” for those becoming childminders, and relaxed rules in England to let childminders look after more children to be introduced.

Pensions & benefits

State Pension: As confirmed at Autumn Statement 2022, the government will also increase benefits, including the State Pension, paid to recipients in the tax year to 5 April 2024 by 10.1%.

This increase in the State Pension means that most pensioners will receive £10,600 in 2023/24, where they have 35 qualifying years. Individuals are being urged to check their contribution record on their Government Gateway account and consider making Class 3 voluntary National Insurance contributions to cover missing qualifying years.

Disability benefits: At present, people with disabilities have to fulfil a work capability assessment to test which work-related responsibilities must to be maintained to receive benefits in full. This will be abolished, and benefits entitlement will be separated from an individual’s ability to work, as part of a planned overhaul of the system. In the future there will only be one health and disability assessment, the Personal Independent Payment assessment. As well as this, a new voluntary employment scheme for disabled people in England and Wales, called Universal Support, will be introduced.

Universal Credit: Two million jobseekers on Universal Credit could face more rigorous sanctions, if they do not take work the government considers appropriate. This will include increased job support for lead child carers who are on Universal Credit. £63 million will be invested to encourage retirees over 50 to train and acquire new skills.

Work, personal taxes & wages

Pension Annual Allowance: Another pension limit increased by the Chancellor in the Budget was the pension AA, which increases from £40,000 to £60,000 from 6 April 2023. The AA effectively limits the income tax relief on pension contributions made in a tax year and a tax charge will arise if the allowance is exceeded. The AA applies to the combined pension input by the individual and, in the case of employees, their employer. For those with high incomes, the AA is tapered. It’s worth noting that an individual’s pension contributions can be very tax efficient depending on their level of income.

The annual allowance is currently tapered down to a minimum of £4,000 if adjusted income exceeds £240,000. As of 6 April 2023 This will change to adjusted income of £260,000 and a minimum of £10,000.

Pensions Lifetime Allowance: The current pension lifetime allowance charge is being abolished from 6 April 2023. The LTA has caused some high earners, particularly doctors, to retire early as tax charges apply on crystallisation of pension funds if the LTA (currently £1,073,100) is exceeded. This will benefit higher earners and has been introduced with the intention of decreasing pressure on the NHS. Those with various lifetime allowance protections should seek advice before making any pension contributions.

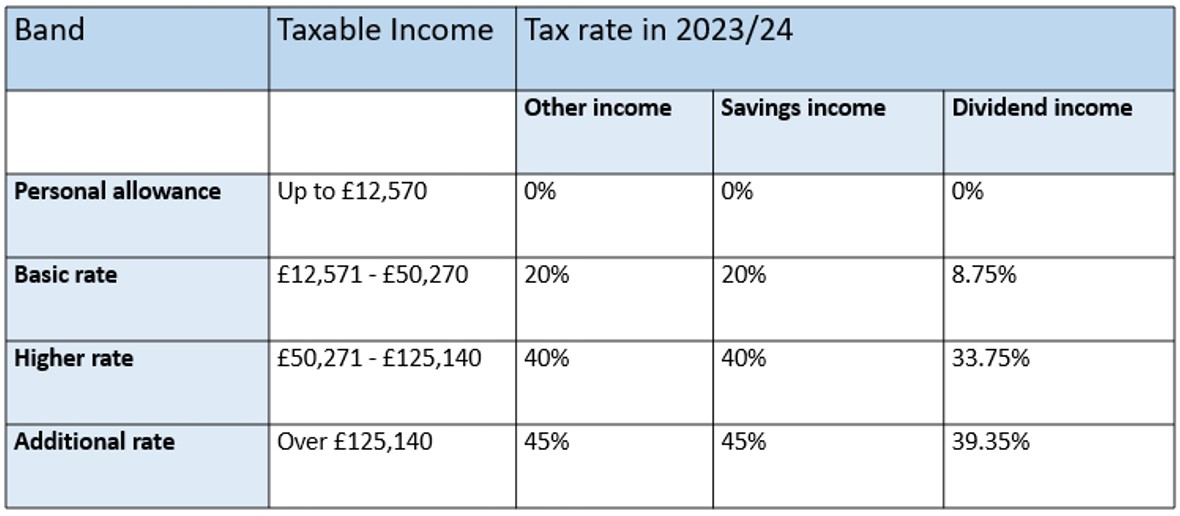

Income Tax: The personal allowance and basic rate band threshold are now frozen in place until 5 April 2028. As earnings increase, individuals will move into higher tax bands. This is often referred to as ‘fiscal drag,’ because it will raise more tax without the government increasing income tax rates. The personal allowance continues to be partially and then fully withdrawn for higher earners, with £1 of personal allowance lost for every £2 of adjusted net income over £100,000.

Additionally, the highest rate of income tax, which is 45% currently on earnings above £150,000, will be paid on earnings of more than £125,140 from April 2023. That means the highest paid could pay hundreds of pounds more a year in income tax.

Please see the table below for up-to-date details:

Other allowances: Savings income continues to benefit from a personal savings allowance of £1,000 for basic rate taxpayers and £500 for higher rate taxpayers. Dividend income attracts a £1,000 dividend allowance in 2023/24, down from the £2,000 allowance seen in previous years. These allowances are in addition to the personal allowance and attract a 0% rate of income tax.

Individual Savings Accounts: Annual subscription limited remain unchanged at £20,000 for Individual Savings Accounts (ISA).

Minimum Wage: The National Minimum Wage goes up by 9.7%: from £9.50 an hour to £10.42 for over 23s.

National Insurance contributions for the self-employed: Self-employed individuals are required to pay Class 2 and Class 4 NICs if their profits exceed £12,570. These NICs are usually collected with the individual’s income tax self-assessment payments. For 2023/24, Class 2 NICs are calculated at £3.45 per week and Class 4 NICs are calculated at 9% on profits between £12,570 and £50,750, and at 2% on profits over £50,750.

Cost of living and the economy

Inflation: The government’s independent forecaster, the Office for Budget Responsibility (OBR) expects the inflation rate, which charts the rising cost of living, to drop to 2.9% by the end of the year, having peaked at over 11%. The target set for inflation is 2%.

Costs: Prices will continue to rise in the shops, but at the rate they have been. However, this does not discount difficult price increases to come. For example, there will be large increases to broadband and mobile bills in April and many homeowners will face higher mortgage demands.

Disposable income: Per person, disposable income will fall by 6% this financial year and the next, according to the OBR. This represents the largest two-year fall in living standards since records began in the 1950s. This may well lead to people feeling pressured to dip into their savings to afford their outgoings.

Business & trade

Corporation Tax: From 1 April 2023, the rate of Corporation Tax will increase to 25% if a company’s profits exceed £250,000 a year. The current 19% rate will however continue to apply where profits are no more than £50,000 a year. If a company’s yearly profits sit between these limits, the profits are taxed at the higher 25% rate, but a ‘marginal relief’ is given to reduce the liability, with the effective rate being closer to 19% for those with profits just over £50,000.

Please be aware of the effects of associated companies on the Corporation tax rate bands.

VAT: The VAT registration and deregistration thresholds will continue to be frozen, until March 2026, at £85,000 and £83,000 respectively, instead of increasing each year in line with inflation.

First Year Allowance: New, temporary First Year Allowances(FYA) will be available to companies incurring expenditure on new unused, qualifying plant and machinery, between 1 April 2023 and 1 April 2026, effectively providing a 100% tax relief in the year of purchase. The qualifying criteria is quite broad although there are exclusions, including cars, plant and machinery for leasing and features integral to a building (for example, heating systems). With regard to ‘integral features’, a smaller 50% FYA will be available.

Subsequent disposals of assets on which one of these FYAs has been claimed will trigger a clawback of tax relief at a rate of 100% or 50% of the disposal proceeds, depending on the rate of the original relief. These new FYAs will mainly be of interest to companies that have already fully utilised their £1million Annual Investment Allowance.

The separate 100% FYA for electric vehicle charge points remains available for unincorporated businesses and companies until Spring 2025.

Venture Capital Schemes: The government is increasing the funds and availability of the Seed Enterprise Investment Scheme for start-up companies. The amount of investment that companies will be able to raise under the scheme will increase from £150,000 to £250,000. The gross asset limit will be increased from £200,000 to £350,000 and the investment must be made within 3 years (increased from 2 years) of trade commencing. In a bid to support these changes, the annual investor limit will be doubled to £200,000. The changes take effect from 6th April 2023.

Fuel: The 5p cut to fuel duty on petrol and diesel, that was due to end in April, will be kept for another year.

Cigarettes & alcohol: Alcohol taxes to rise in line with inflation from August, with new reliefs for beer, cider and wine sold in pubs. Tobacco duty will increase by 2% above inflation and 6% above inflation for rolling tobacco.